Are you ready to take your financial future into your own hands? Welcome to the world of Sharkshop.biz Credit Score Services, where understanding and improving your credit score becomes an exciting journey rather than a daunting task! In today’s fast-paced economy, a solid credit score is more than just a number; it’s your ticket to better loan rates, lower insurance premiums, and even job opportunities.

But with so much information out there—often contradictory—it can be challenging to know where to start. That’s where we come in! Join us as we dive deep into SharkShop’s innovative services designed to demystify credit scores, empower you with knowledge, and help you achieve the financial freedom you’ve always dreamed of. Let’s make navigating the waters of credit management not only manageable but also enjoyable!

Introduction to SharkShop Credit Score Services

Navigating the world of credit scores can feel like diving into uncharted waters. For many, these numbers hold the key to major life milestones—like securing a mortgage or landing that dream job. But how do you ensure your score reflects your financial health? Enter SharkShop, your trusted partner in understanding and improving your credit score.

With tailored services designed for all users,Sharkshop.biz demystifies this crucial aspect of personal finance. Whether you’re starting from scratch or looking to enhance an already good score, there’s something here for everyone. Let’s explore how SharkShop can help you take control of your financial future and swim confidently towards better opportunities!

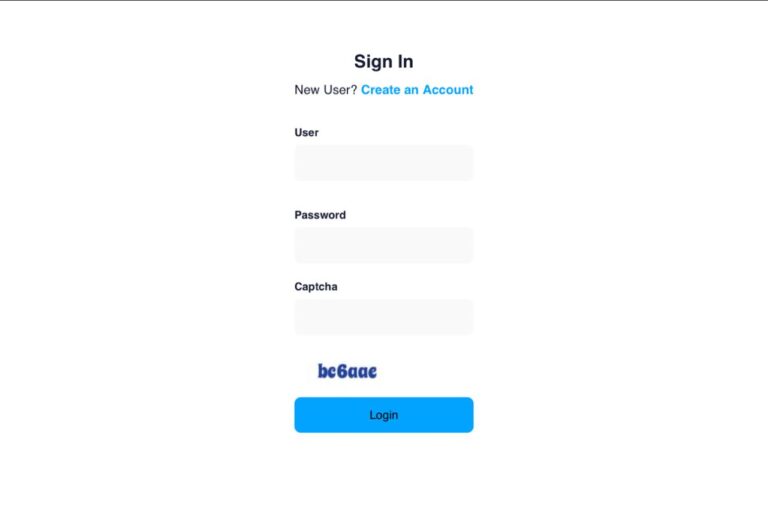

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding Credit Scores and Their Importance

Credit scores are numerical representations of your creditworthiness. They range from 300 to 850, with higher scores indicating better credit health.

Lenders use these scores to assess the risk of lending money or extending credit. A strong score can lead to lower interest rates and favorable loan terms.

Understanding how your score is calculated is crucial. Factors like payment history, amounts owed, length of credit history, new credit inquiries, and types of credit all play a role.

A good score not only influences loans but also impacts rental applications and even job prospects in some cases. It’s essential to keep track of your score regularly and understand what affects it.

This awareness empowers you to take proactive steps in managing your financial health effectively.

How SharkShop Can Help Improve Your Credit Score

SharkShop offers tailored solutions to enhance your credit score effectively. Their team of experts analyzes your current credit profile, pinpointing areas that need improvement.

With personalized advice and actionable strategies, SharkShop equips you with the tools necessary for better financial health. They help you understand the factors affecting your score and guide you on how to address them.

One significant advantage is their ongoing support throughout the process. Whether it’s disputing inaccuracies or managing debts, SharkShop stands by your side every step of the way.

Additionally, they provide educational resources that empower clients to make informed decisions about their finances in the long run. This commitment not only boosts scores but also builds confidence in handling future credit-related situations.

Related: Feshop

The Process of Using SharkShop Credit Score Services

Getting started with SharkShop is simple and user-friendly. First, you create an account on their website. This process takes just a few minutes.

Once your account is set up, you’ll provide necessary details about your financial history. SharkShop values your privacy and ensures all information remains secure.

Next, the platform generates a personalized credit report tailored to your unique situation. You can easily access insights into factors affecting your score.

SharkShop then offers actionable recommendations to help improve your credit standing. You’ll receive guidance on managing debt and optimizing credit utilization.

Throughout the journey, customer support is available for any questions or concerns that may arise. Their team is dedicated to helping you navigate the intricacies of credit scores effectively.

Each step in this process empowers users, making it accessible for everyone looking to enhance their financial health through informed decisions.

Common Misconceptions About Credit Scores and How SharkShop Debunks Them

Many people believe that checking their credit score will lower it. This myth can create unnecessary fear around monitoring your financial health. In reality, checking your own score is considered a soft inquiry and has no impact on your credit.

Another common misconception is that closing old accounts improves your score. SharkShop clarifies that older accounts contribute to the length of credit history, which positively affects scores when kept open.

Some assume only loans influence their credit scores. However, SharkShop emphasizes that credit utilization and payment history are equally significant. Managing these factors effectively can lead to better outcomes.

Finally, many think they need perfect credit for approval on loans or cards. SharkShop educates users about various options available even with less-than-perfect scores, opening doors to opportunities many thought were closed off.

Tips for Maintaining a Healthy Credit Score with the Help of SharkShop

Maintaining a healthy credit score is essential for achieving financial goals. With SharkShop , you gain valuable insights to help keep your credit in check.

Start by monitoring your credit regularly through SharkShop’s easy-to-use platform. You’ll receive timely alerts about changes in your score or new accounts opened in your name.

Paying bills on time is crucial. Set up reminders or automate payments to avoid late fees that could negatively affect your score.

Utilize SharkShop login resources for budgeting and managing debt effectively. This can provide clarity on how much you owe and the best strategies for repayment.

Also, consider keeping old credit accounts open to lengthen your credit history. SharkShop offers guidance on making informed decisions about when to close accounts.

Lastly, maintain a low balance on revolving accounts like credit cards—ideally under 30% of the limit. With these practical tips from SharkShop, you’re empowered to build and sustain a robust credit profile.

Testimonials from Satisfied SharkShop Customers

At SharkShop, customer satisfaction is paramount. Many individuals have successfully enhanced their credit scores with our services.

One client, Emma, shared her experience after struggling for years with a low score. “I never thought I could qualify for a mortgage,” she said. After working with SharkShop, she saw significant improvements in just a few months.

Another user, Mark, expressed gratitude for the personalized support he received. “The team was always available to answer my questions,” he noted. “Their advice helped me understand where I was going wrong.”

Customers often highlight the easy-to-use platform as well. Lisa remarked on how accessible all resources were: “Everything you need is right at your fingertips.”

These testimonials reflect the commitment of SharkShop to empower users and transform their financial futures through effective credit score management strategies.

The Difference Between Different Credit Score Services and Why SharkShop Stands Out

Not all credit score services are created equal. Many offer basic reports but miss out on personalized guidance and actionable insights. This is where SharkShop distinguishes itself.

SharkShop combines advanced technology with user-friendly tools, empowering clients to understand their credit scores better. Unlike traditional services that merely provide numbers, SharkShop emphasizes education and strategy.

The platform offers tailored recommendations based on individual financial situations. Users can access not just their scores but also detailed analyses of factors affecting those scores.

Additionally, the customer support team at SharkShop goes above and beyond, providing real-time assistance when you need it most. The focus isn’t solely on improving numbers; it’s about fostering long-term financial health.

With a commitment to transparency and user empowerment, SharkShop truly stands apart from standard credit score offerings.

Frequently Asked Questions about SharkShop Credit Score Services

Many people have questions about SharkShop’s credit score services. One common query is how long it takes to see improvements in your credit score after using their services. While results can vary, many customers report noticeable changes within a few months.

Another frequent question involves the cost of these services. SharkShop offers various plans to suit different budgets, making it accessible for everyone looking to enhance their financial health.

Users often ask if they can access their scores at any time. With SharkShop, you receive real-time updates and reports so you stay informed about your credit status whenever needed.

Privacy concerns are also prevalent. Rest assured, SharkShop cc prioritizes data security and employs advanced encryption methods to protect your information.

Lastly, potential clients wonder if there’s support available when navigating the process. The dedicated customer service team at SharkShop is always ready to assist with any inquiries or challenges you may encounter along the way.

Conclusion: Why You Should Choose SharkShop for Your Credit Score Needs

Choosing the right partner for your credit score needs can make a significant difference in your financial journey. Sharkshop.biz offers comprehensive services designed to help individuals understand, improve, and maintain their credit scores effectively. With a wealth of resources and expert guidance at your fingertips, you get not only knowledge but also actionable insights tailored to your specific situation.

Many customers have experienced transformative results by utilizing SharkShop’s services. The unique approach blends technology with personalized support to ensure that improving your credit score is both achievable and sustainable.

With an array of features that set it apart from other credit score services, SharkShop stands out as a reliable choice. Their commitment to debunking myths around credit scores empowers clients with accurate information necessary for making informed decisions.

Whether you’re just starting out or looking to enhance an existing score, choosing SharkShop means investing in a brighter financial future. You deserve expert assistance that prioritizes your goals and works tirelessly on your behalf. Embrace the opportunity for growth with SharkShop today!