Are you tired of seeing your credit score hold you back from achieving your financial dreams? Whether it’s securing that dream home, landing a low-interest rate on a car loan, or simply gaining peace of mind, a strong credit score is key.

Enter SharkShop.biz the revolutionary platform designed to empower consumers like you to take control of their credit health! In our ultimate guide, we’ll dive deep into how SharkShop can transform your approach to managing and improving your credit score. Get ready for practical tips, insider secrets, and all the tools you need to swim confidently through the murky waters of personal finance. Let’s make waves together as we unlock the potential of your credit with SharkShop!

Introduction to SharkShop and its benefits for improving credit scores

Are you tired of being turned down for loans or paying higher interest rates because of a less-than-stellar credit score? If so, you’re not alone. Many people struggle with their credit ratings, often feeling overwhelmed by the process of improving them. Enter SharkShop—a powerful tool designed to help users take control of their financial futures and boost their credit scores effectively.

SharkShop.biz is more than just an app; it’s your ultimate ally in navigating the complexities of credit management. With a range of user-friendly features and actionable insights, this platform stands out as an essential resource for anyone looking to enhance their financial health.

Whether you’re starting from scratch or trying to recover from past mistakes, SharkShop can guide you on your journey toward better credit standing. Let’s dive deeper into what makes SharkShop a game-changer!

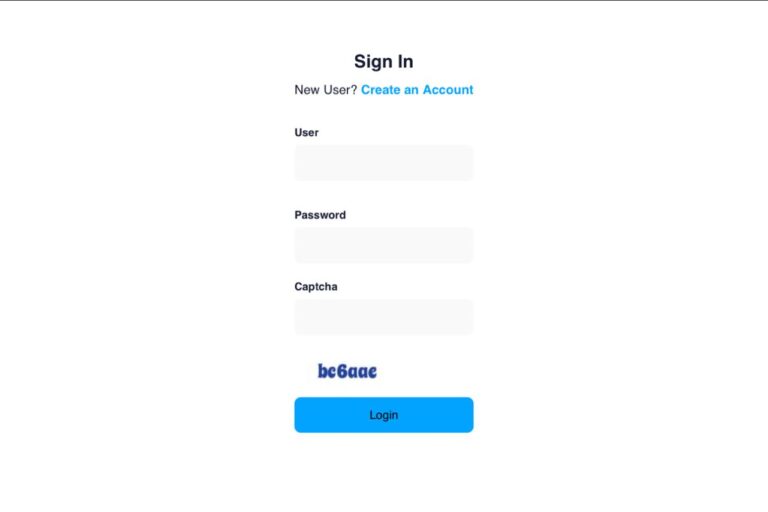

A Screenshot of Sharkshop (Sharkshop.biz) login page

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness. It reflects how well you manage debt and repay loans over time. Typically ranging from 300 to 850, this score plays a crucial role in financial decisions.

Credit bureaus calculate scores based on various factors, including payment history, amounts owed, length of credit history, types of credit used, and new credit inquiries. Each factor carries different weights in the scoring model.

Lenders use this number to assess risk when considering loan applications or setting interest rates. A higher score often leads to better loan terms and lower interest rates.

Understanding your credit score SharkShop can empower you to take control of your financial future. By keeping track of it regularly, you can identify areas for improvement and make informed financial choices that benefit you long-term.

Importance of Having a Good Credit Score

A good credit score can significantly impact your financial life. It determines your eligibility for loans, credit cards, and even rental agreements. Lenders often see a high score as a sign of reliability.

When you apply for a mortgage or auto loan, your credit score plays a crucial role in the interest rate you receive. A higher score generally means lower rates, which translates to substantial savings over time.

Beyond loans and mortgages, many employers now check credit scores during hiring processes. This trend emphasizes the importance of maintaining a strong financial reputation.

Additionally, insurance companies may use your credit history to set premiums. A good score could lead to lower costs on car insurance or homeowners insurance policies.

In today’s world, where financial opportunities abound or dwindle based on numbers alone, fostering a healthy credit score is more important than ever.

How SharkShop Can Help Improve Your Credit Score

SharkShop offers a unique approach to improving your credit score. It provides personalized insights tailored to your specific financial situation. This means you receive advice that resonates with your needs.

One of the standout features is its credit monitoring tool. With real-time updates, users can track changes and understand what impacts their scores.

Additionally, SharkShop simplifies payment management. Users can set reminders for bills or automate payments, ensuring nothing slips through the cracks.

Another benefit lies in educational resources available on the platform. Articles and videos help demystify credit scores and teach actionable strategies for improvement.

Engaging with SharkShop’s community further enhances accountability. Sharing experiences motivates users to stay committed to their goals while learning from others’ journeys in building better credit profiles.

Features and Tools of SharkShop for Building Credit

SharkShop offers a robust suite of features designed to help users build and improve their credit scores effectively. One standout tool is the Credit Builder account, which allows users to make regular payments that get reported to major credit bureaus. This consistent activity helps establish a positive payment history.

Another useful feature is the personalized credit score tracker. Users can monitor their progress in real-time, gaining insights into factors affecting their score. The app provides valuable tips tailored specifically for each user’s financial situation.

Additionally, SharkShop login includes educational resources like articles and videos focused on understanding credit management. With these tools, you not only build your score but also become more informed about maintaining it long-term.

Lastly, the community forum lets users share experiences and strategies, fostering an encouraging environment for growth in personal finance practices.

Tips and Tricks for Maximizing Your Use of SharkShop

To get the most out of SharkShop, start by setting clear goals for your credit score. Knowing what you want to achieve helps tailor your approach.

Next, take advantage of the educational resources available within SharkShop. These tools can provide insights into managing debt and improving financial habits.

Regularly monitor your progress through the app’s dashboard. Keeping track of changes in real-time allows you to adapt strategies as needed.

Don’t hesitate to engage with community forums or support groups offered by SharkShop. Sharing experiences with others can lead to valuable tips and motivation.

Lastly, consider using automated payment reminders. This feature ensures that bills are paid on time, which is crucial for maintaining a healthy credit history.

Success Stories from Users of SharkShop

Users of SharkShop have shared inspiring journeys toward better credit scores. Many started with low ratings, feeling overwhelmed and unsure about their financial futures. However, after utilizing the platform’s resources, they experienced significant improvements.

One user highlighted how SharkShop’s tailored recommendations helped her pay off debts systematically. She noted a 100-point increase in just a few months. This newfound confidence led her to secure a loan for her dream home.

Another success story came from someone who used SharkShop to monitor his credit regularly. By catching errors early on and disputing them through the app, he was able to boost his score dramatically.

These real-life experiences showcase the power of using innovative tools like SharkShop cc in transforming financial health and achieving personal goals. The community around this platform continues to grow as more people share their achievements.

Alternatives to SharkShop for Improving Credit Scores

If SharkShop isn’t the right fit for you, there are several alternatives worth exploring. Many users turn to credit monitoring services like Credit Karma or Experian. These platforms provide free access to your credit score and offer personalized tips on how to improve it.

Another option is using secured credit cards from banks that report payments to major bureaus. This allows you to build credit through responsible use while keeping spending in check.

Additionally, apps such as Self can help create a savings account linked to a small loan, reporting timely payments and boosting your credit history simultaneously.

For those seeking professional guidance, consulting with a financial advisor could be beneficial. They can craft specific strategies tailored just for you while providing support along the way. Each alternative has its pros and cons; exploring them may lead you closer to achieving your desired credit score.

Conclusion: Why You Should Consider Using SharkShop for a Better Credit Score

Using SharkShop.biz could be a game-changer for your financial health. With its intuitive platform and efficient tools, it simplifies the process of improving your credit score. This can open doors to better loan rates, credit cards with more rewards, and even housing opportunities.

The benefits are clear. You get personalized insights tailored to your unique financial situation. The features like auto-pay reminders and credit monitoring make staying on top of your finances easier than ever. Plus, you join a community of users who have seen real improvements in their scores.

Whether you’re starting from scratch or looking to enhance an existing score, SharkShop offers valuable resources that cater to different needs and goals. Choosing this platform means investing in a brighter financial future—one where good credit works for you instead of against you. So why not take that step toward better credit today?